by MC

Journalists and newsies alike love to jump on the bandwagon and point out the obvious, particularly when it comes to the stock market. In recent days the NASDAQ touched an all-time high and the euphoria of market highs seems to be permeating the minds of the average investor and even fooling some into believing this could be a great time to buy into equities. In my experience, it almost always to pays to be a contrarian – to take the opposite view and to search for cracks in the foundation.

In famed British investor Sir John Templeton’s words:

“Bull markets are born on pessimism, grown on skepticism, mature on optimism and die on euphoria. The time of maximum pessimism is the best time to buy, and the time of maximum optimism is the best time to sell.”

Let me begin with a brief background of how I stumbled into building this view. The other day my wife and I decided to browse homes for sale in Highlands Ranch, CO and let’s just say we were not entirely surprised by the lack of affordable single-family homes. We initiated a simple search for a decently-sized house (2,000+ sq. ft., 2 bdrm, 2 bth) with a reasonable price ceiling of $400k and came up with a surprisingly small list of homes that fit that criteria (see map below).

The Denver metro area has experienced significant growth over the past several years is one of, if not the hottest, housing market in the western U.S. After returning such dismal results, I jokingly mentioned to my wife we should consider buying a place in Vegas – plenty of land, lower cost of living, no more damn snow, etc. and so I set off to see what Vegas had to offer.

I was quite surprised when I popped open my real estate search of Henderson (a somewhat comparable suburb to Highlands Ranch, though much bigger). Not only were there a significantly higher number of homes for sale, but there were far more pre-foreclosure and auction (represented by blue dots) homes on the market (see map below).

Though I did not take the time to count the exact amount, the sheer number of blue dots on the Henderson map vs. the Highlands Ranch map was staggering. Consider this: Highlands Ranch as a population of 100,00 people and the amount of homes for sale equaled 289. That’s 0.00289 homes for sale per person in Highlands Ranch vs. 0.00567 (1,531/270,000) homes for sale per person in Henderson. There’s almost a 3x difference between the two! Of course there are many factors that can explain this difference (such as available land area, average income, employment type, etc. etc.) but I was quite surprised, nevertheless. Whether or not this ratio of average homes for sale per person is normal is beyond my expertise. Hopefully some real estate expert reading this can point out a normal ratio to me, but that is not what piqued my curiosity about the economy. What I was curious about was the number of foreclosed homes (reminiscent of 2008). That just looked high to me so I dug a little deeper to see what else I could find. Below are key points of some of those details:

- Foreclosures in Clark County have actually been falling over the years and are at historical lows (see chart below) – Alright, so not a big deal as it turns out, on to the next stat…

source: RealtyTrac

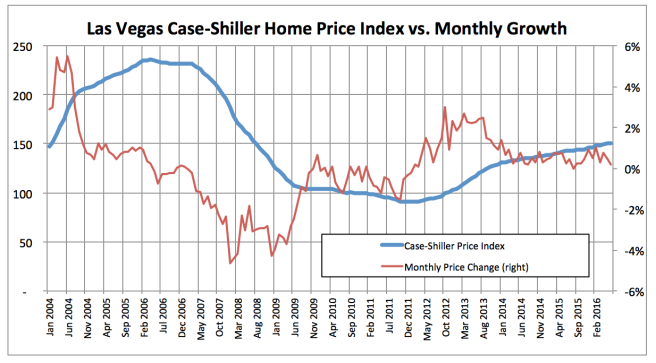

- Home prices in Las Vegas have seen slower appreciation over the years – OK, but also not a major point of concern…yet

Source: St. Louis Fed

- Employment in the Leisure and Hospitality industry has been slowing the past several years, with a recent uptick in the sector – the heartbeat of Las Vegas is still alive, no major news here

Source: St. Louis Fed

- Unemployment in Las Vegas made a sharp U-turn upward in recent months (red circle) – Now, that is something to look into

Source: St. Louis Fed

Las Vegas Unemployment on the Rise

According to the St. Louis Fed, seasonally-adjusted unemployment in Sin City has potentially hit a low point earlier this year as the rate has been increasing fast over the course of the first half of 2016. The graph above shows Vegas’ unemployment has risen from 5.7% to as high as 6.8%, but recently dropped to 6.5% for July. What’s driving this is still unclear, but local agencies reported layoffs from two solar companies (Solar City and Go Solar, the former a company backed by Elon Musk) as well as the closure of a chlorine plant. Are more layoffs expected to occur? If so, in what industry? That question is still up for debate and some additional research will have to be conducted to uncover more details, but a sudden and rapid reversal in unemployment does not bode well as most companies do not take layoffs easily. Layoffs are typically conducted with the expectation things will worsen in the near future. This reversal in unemployment, in my opinion, could be the start of a new trend rather than just a bad data point.

Unemployment Rising Elsewhere?

Yes. Given Las Vegas’ recent increase in unemployment, it only makes sense to look at the one state where the majority of its visitors come from: California. Cali’s unemployment rate has been dropping continuously since the 2008 recession, but one area in particular appears to have bottomed-out – Silicon Valley. Data from the St. Louis Fed for the cities of San Jose, Sunnyvale and Santa Clara show the unemployment rate hovering at about 4% (chart below).

Source: St. Louis Fed

It seems some of California’s tech companies have hit difficult times lately with multiple firms reporting layoffs. Some sources have even indicated layoffs have more than doubled from last year (see story here).

Some of the Valley’s largest companies include: Cisco, Apple and Google. In fact, Cisco estimates to layoff 5% of its global workforce (Cisco Layoffs) after some surprises in its first quarter earnings call, namely slowing growth and compressed margins. Additionally, Apple seems to have laid off its recruiting contractors and has slowed hiring (see story here). The evidence is certainly starting to mount.

Conclusion

While the U.S. economy seems to be stable at present with the stock market setting all-time highs, the Perceptive Investor should remain skeptical, adopt a contrarian view and be on the lookout for weaknesses so as not to get caught flat-footed. A rising tide may lift all ships, but not all ships are constructed equally. Only when the tide recedes, will the damage be known, but by then it will be too late.

There are certainly some bearish factors out there, but while none at this point clearly signal an impending downturn, a few certainly warrant closer attention, specifically:

- The sudden reversal of the unemployment rate in Las Vegas AND

- The bottoming-out of Silicon Valley’s unemployment rate at 4% and increased amount of layoffs

Stay tuned for more as we monitor the situation and continue to uncover evidence supporting (or perhaps even contradicting) our view. We shall see.

Notes: All unemployment figures are seasonally adjusted

Disclaimer: I currently hold the following short positions: the S&P 500, NASDAQ and crude oil